WRITTEN BY EVAN SHAPIRO

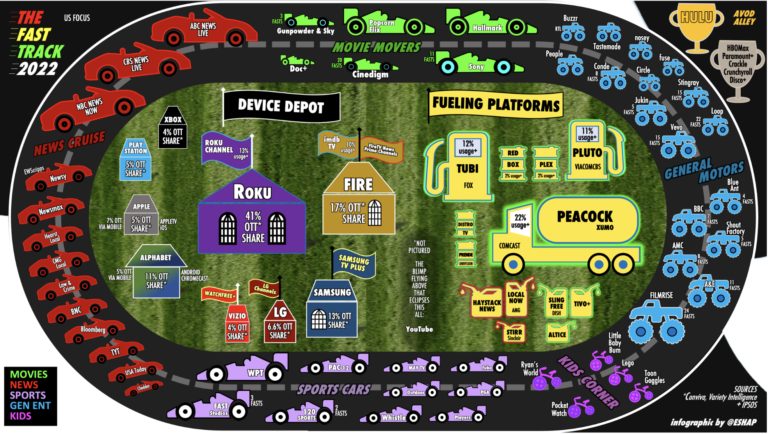

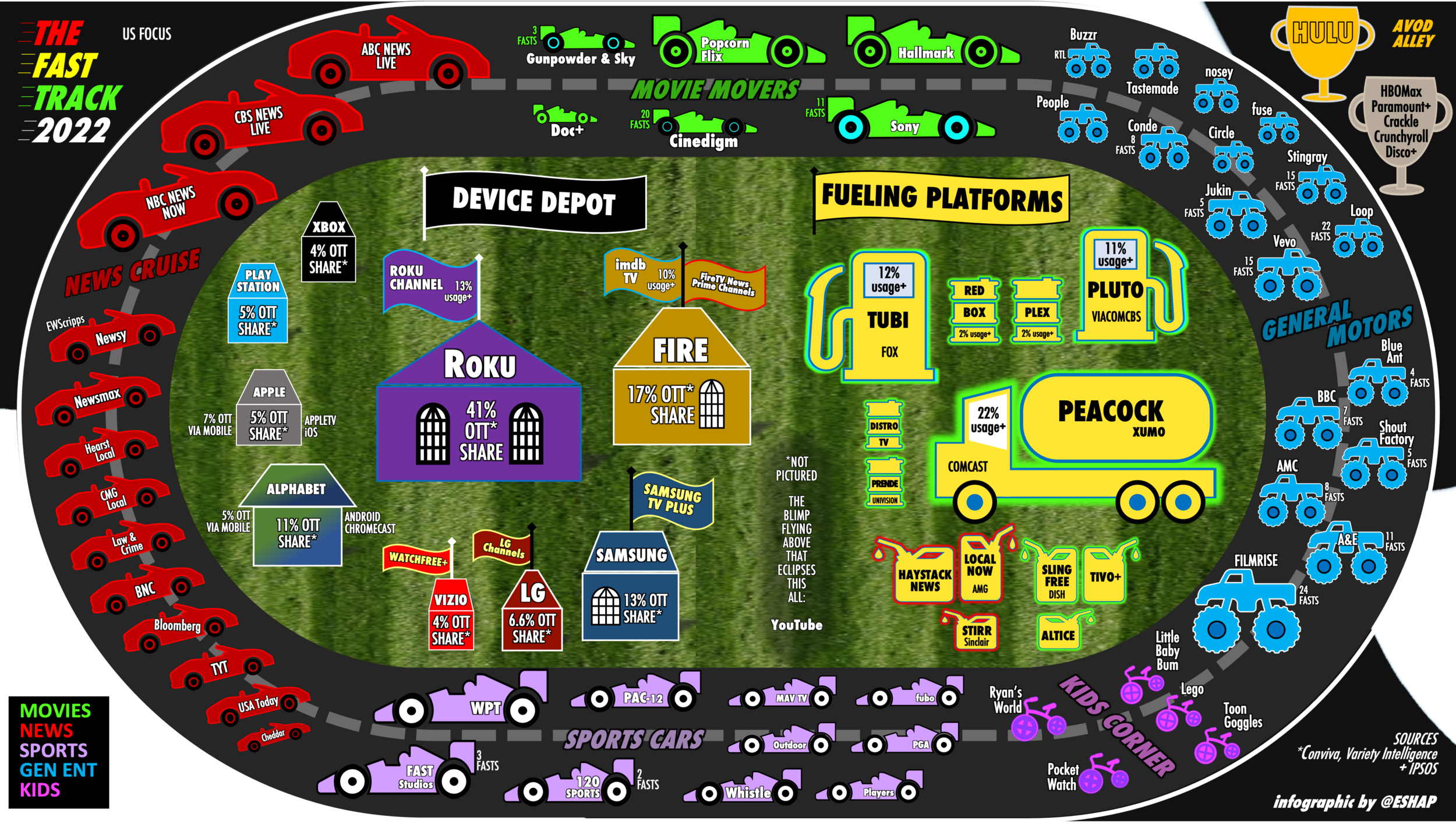

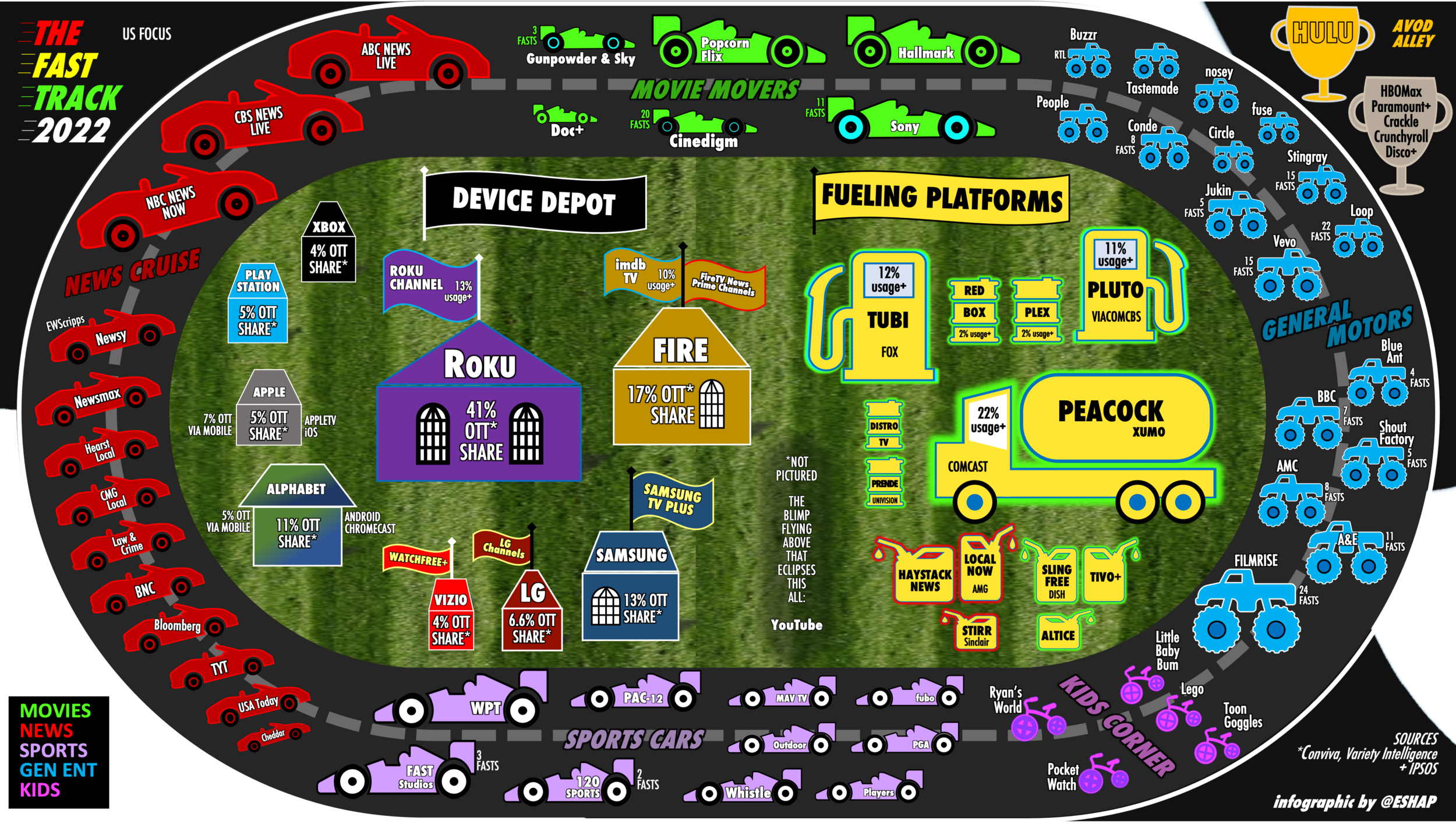

When our friend Evan Shapiro approached us about running his latest media map of the FAST ecosystem, we were more than a little thrilled, as the FAST ecosystem will be the subject of our next few TVREV Special Reports. Shapiro’s map does an excellent job of capturing the massive (and massively confusing) complexity of the FAST ecosystem today, as well as just how much (to quote the man himself) the data sucks. That said, Shapiro has done a yeoman’s job of sorting out the key categories and players in this latest evolution of the television industry.

A report from roadside on the FAST Channel Track

THE FAST TRACK 2022 – A MAP OF THE FAST UNIVERSE

In the 1970s and 80s, Los Angeles boasted one of the first, and one of the all-time best, 24-hour movie networks, Z Channel. In the 80s it was programmed by an iconoclast named Jerry Harvey, the first programmer to ever air the director’s cut of Heaven’s Gate, along with perhaps the best curated portfolio of foreign, experimental, and classic films to ever hit a television set. Alexander Payne and Quentin Tarantino both credit Z Channel with inspiring them to make film. 18 years ago, I was fortunate to work on a documentary about Z Channel with director Xan Cassavetes.

Simultaneously, Chuck Dolan launched a movie-only channel in Manhattan called Home Box Office, and Ted Turner launched the first-ever satellite delivered broadcast channel which he literally named Watch This Channel Grow (WTCG). These niche channels were the birth of Cable TV, which quickly opened the gates to a flood of genre specific, niche channels such as Music Television (MTV), the Cable News Network (CNN), Black Entertainment Television (BET) and the ridiculously named Entertainment and Sports Programming Network (ESPN).

These networks are all now staples of entertainment, so cemented in the television industry they are now seen as matured, even old-school businesses, being disrupted, and usurped by streaming platforms. When they started, though, compared to the television establishment of Broadcast TV, these channels were adorably small, boot-strapped start-ups, that many in the media industry considered too niche and specific to ever work. “Who’s gonna watch music videos all day?”

It’s these moments from the early days of cable that come to mind when I look at the emergence of free ad-supported streaming TV – FAST. FAST (the term first coined by TVREV’s Alan Wolk) is the hot content platform of the moment. And in many ways the birth of FAST is eerily akin to the origin of Cable. In many ways, they are also polar opposites.

Like TV Networks, FAST channels are linear – stuff is on, and then it’s over (although we should note that one of the secrets of the FAST ecosystem is that many FASTs, Tubi in particular, rely heavily on AVOD – even The Roku Channel defaults to non-linear AVOD). As with the early days of Cable TV, everyone seems to be launching channels, with visions of moneybags dancing in their heads. Unlike cable, however, FAST channels have very few barriers to entry, requiring very little start-up costs aside from the acquisition of content. Like early Cable TV, new distribution platforms for FAST are opening rapidly, and many are walled-gardens, catering to individual cohorts. Unlike cable, satellite and telco platforms, there are no affiliate fees to underpin the business model; instead, publishers must rely solely on advertising, which they are required to share substantially with their distributors. Like nearly every Cable TV network in its early days, FAST channels are often hyper-niche programmers, using repurposed, licensed, and non-exclusive content, running on loops, to fill out their 24 schedules. Like many cable networks in their infancies, few individual FAST channels have substantial viewership to speak of, rather the platforms that aggregate FASTs are attracting sampling, among curious audiences, browsing the offerings.

FAST PROLIFERATION

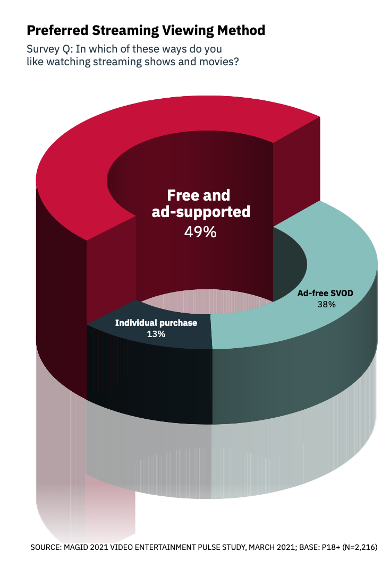

Perhaps the most notable relationship between Pay TV and FAST, however, may be how each was born of opposing consumer behaviors. Cable TV is a pay to play product, created by the need for more specific and varied programming by those willing to pay for it (and by cable distributors looking to hook consumers with sticky bundles of content). Conversely, FAST has emerged due to subscription fatigue and choice paralysis among television audiences, who are inundated with charges for subscription services and weary from having to search for things to watch from in a limitless chain of digital warehouses.

FREE IS IN

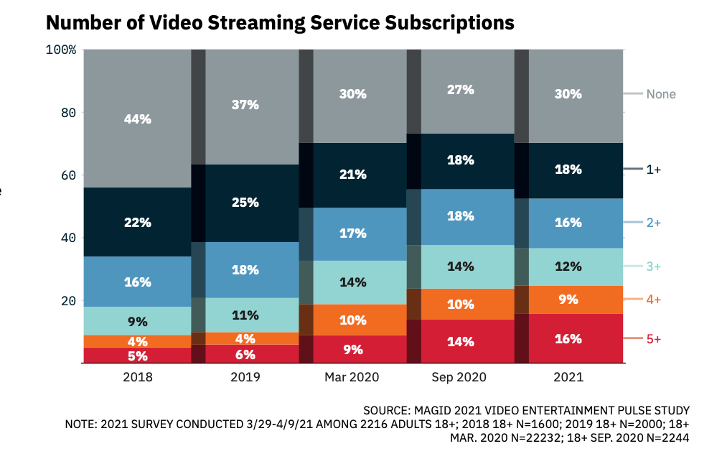

After years of limitless appetite for new paid subscriptions, in 2021, consumers seem to have finally said “enough!” While the average American home still has many paid premium subscriptions, according to Magid’s yearly Pulse survey, the fastest category for the number of SVOD services subscribed to was “None.”

NONE OF THE ABOVE

Between GenZers leaving the dorm or nest and refusing to sign up for Cable TV, Millennials with kids cutting the cord, and Boomers cutting back on costs, Pay TV is now losing an average of 1.7 million subscribers per quarter, and will likely shed 7 million (or more) subs in 2022. While Netflix, Prime, Disney+, HBOMax and Hulu can help fill the gap, the combined costs for all those services is now $63 per month, without any ads, after new price increases for Netflix and Amazon kick in. Add in AppleTV+, Peacock, Paramount+, Discovery+ and any other myriad pay services, and the average home could be paying nearly as much for SVODs as they once paid for Cable TV – more when you consider that if you cut the TV cord, the cost of broadband typically increases.

This explains the growing interest and affinity for free streaming services which require neither a Pay TV bundle nor an SVOD logon, are increasingly available on devices everywhere, and which offer a wide range of content across countless interests. Whether you want a channel dedicated ONLY to Bob Ross and his happy little trees, or to the World Poker Tour; around the clock classic TV sitcoms like Full House, or 24 hours a day of Lego content; music channels that play like OG MTV, or services that offer endless episodes of Jerry Springer – FAST has got a channel for you.

However, just like the Cable/Pay TV ecosystem, programmers are finding that just throwing up a signal and a block of programming on a loop is not enough. And just like the maturation process of Cable TV, winners and losers are beginning to shake out in the FAST race.

This is why, after a year of explosive growth in FAST in 2021, and a year ahead in which I anticipate substantial and fundamental changes to the basic underpinnings of the free streaming ecosystem, I decided to map out the world of FAST, lay out the trends that have appeared, and make some predictions for the coming 12 months.

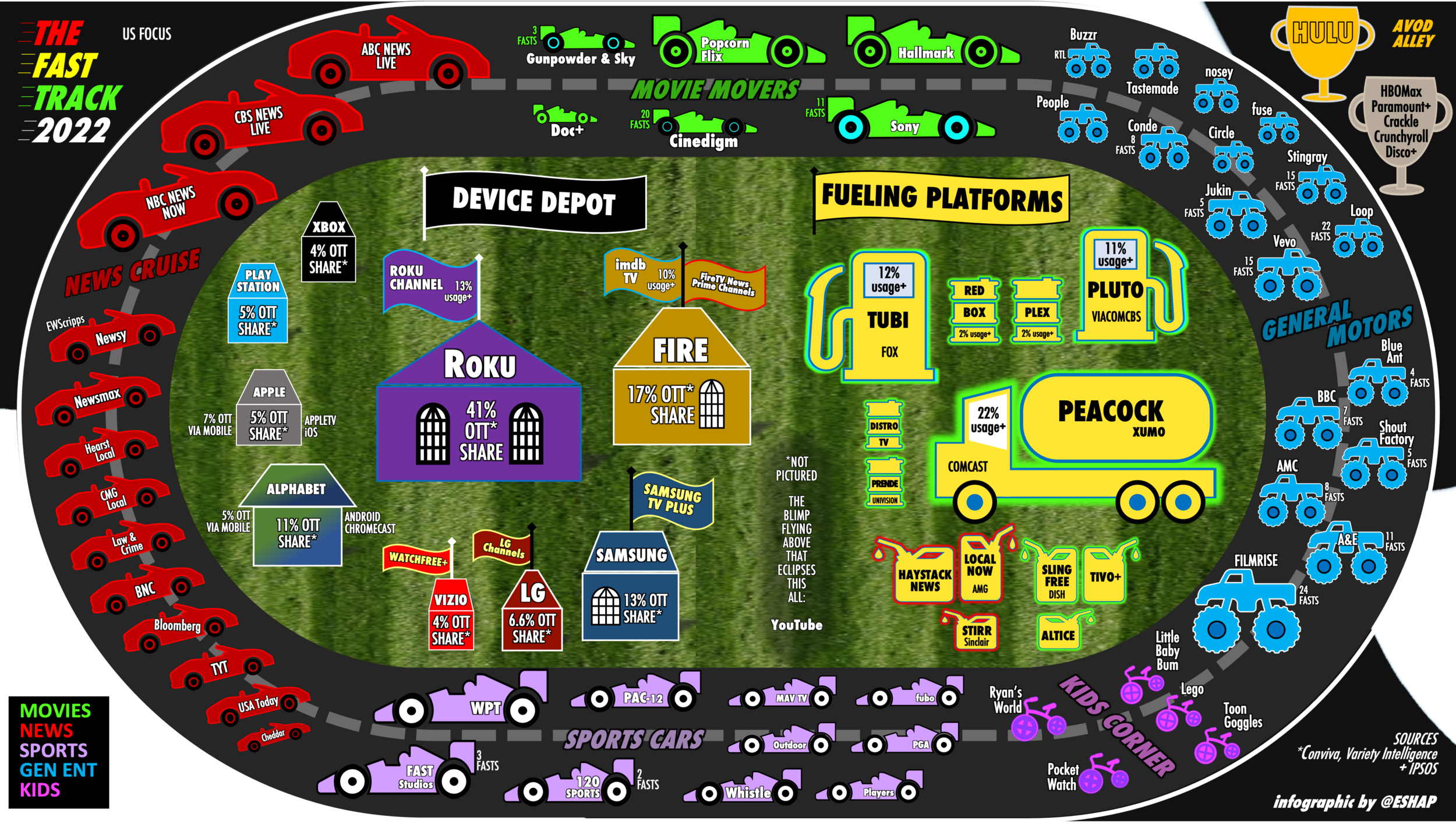

First, about the graphic itself. This is not meant to be an exhaustive list of every channel out there. There is no amount of space that could possibly hold all of them. Unlike Cable TV, anyone can start a linear digital feed and call it a FAST channel. But existing does not equal distribution. To be included on this track, you must be on a preponderance of FAST platforms – at least four of the major devices or aggregator platforms.

Second, the channels are grouped by genres, and within the genres, channels and channel groups are sized by the amount of viewership they received, based on a combination of data from IPSOS, Magid, Variety’s Intelligence Platform and a series of interviews with platform and device insiders.

Streaming Live News from big brands, True Crime, Single Series channels, or ‘binge channels,’ and movie channels with premium content from major and mid- major studios are all driving the most usage on the free streaming platforms. It boils down to discovery and recognizable shows and brands which make it easy for the audience to quickly choose something to watch.

Stefan Van Engen, SVP of Programming and Partnerships, XUMO

This quote from Van Engen nicely captures the consensus of FAST platform operators and managers, about the pecking order of FAST programming genres, based on their consistent popularity among users.

“Movies” is reported to be by far the most viewed category of content in the FAST universe. On my Track, however, not all FAST movie channels are specifically identified. This is because aggregating platforms such as Pluto, Tubi, Peacock and Xumo have numerous owned-and-operated movie channels of their own. So, while the green Movie cars such as Hallmark and Popcorn Flix are on the Track proper, the platforms are in the Fueling Platform infield, with their Movie channels are denoted by their green glow.

This is one of the biggest conundrums on the FAST Track: The biggest platforms and nearly all the device-makers operate their own free streaming channels, which are almost always the most-watched channels on their platforms. This makes it doubly-hard for those channel operators who aren’t large platforms owned by vertically integrated media companies.

The second most-watched genre of FAST is News, denoted in red, with leaders such as ABC, CBS, and NBC. Specifically notable is the usage of FAST News by younger demographics, and the increasing attraction among these viewers for local FAST channels. So, while big News brands such as ABC News, CBS News Live and NBC News Now do quite well on FAST, so do wholly locally focused FASTs such as Hearst and CMG’s collection of local stations, and local news aggregators such as Haystack and Local Now, all of which boast their own apps, as well as garnering distribution via the aggregator Platforms. Additionally, the big brands have taken note of the popularity of the free local News streams, with ABC and CBS recently announcing free FAST streams for their local affiliates.

THINK LOCALLY

True Crime is reported to be the next most-popular category in FAST, with channels like Crime 360 from A&E, Total Crime from Blue Ant and Unsolved Mysteries from FilmRise. The latter example points to another interesting, and trendy FAST sub-category: the single-show binge channels. Programmers such as FilmRise, Shout Factory, A&E, Cinedigm, AMC use brand-name shows such as Hell’s Kitchen, MST3K, Tiny House Nation, Bob Ross, and The Walking Dead, to build FASTs using what Cable TV calls “stacking,” that lure viewers in, and lulls them into a lean-back night of streaming (although I imagine that like The Office and Friends on SVOD, these channels are used as much for “company,” while doing laundry, homework or housework, as much as they are actually being “watched”). These binge-channel FASTs are typically a part of a larger set of FASTs, from channel groups who now dominate the general entertainment sector (“General Motors” on the Track), which until recently has been mostly a confusing wilderness of re-purposed short-form content and music videos.

Sports has some big players, but not all that much actual sports. This will continue to be a challenge for sports FASTs, until and unless – like World Poker Tour – they secure the rights to leagues and live playmaking. More on this in a bit.

Kids Corner has fewer players, with little usage. This is due in large part to massive kids players such as Nick and Disney staying out of the race, YouTube dominating the free to watch kids category, and Netflix and Prime offering massive libraries of premium kids content to Millennial cord-cutting Parents. It’s worth noting that Ryan’s World, which is the biggest player in Kids Corner, is an adaptation of a popular YouTube channel, and is run by an 8-year-old.

Streaming/Connected TV devices such as Roku, Fire TV and Samsung are in the Device Depot infield section. As mentioned above, however, these CTV devices also have their own FAST channels or streaming Platforms. Those are denoted via their flags. The Platforms are sized by their estimated share of streaming audience in North America, according to Conviva, a number, it should be pointed out, that several of the device OEMs dispute. The FAST Platforms are sized by their total share of audience. That data comes from a survey done by Variety and IPSOS where viewers were asked to review a list of 25 free video and movie services and report on which ones they had watched in the past month, e.g., not actual measurement data.

This brings me to a major finding from my FAST research: The data sucks. Or it doesn’t so much suck, as it’s a tower of babble, built out of black boxes, surrounded by walled gardens, laden with thorns. Each platform and device have their own data stack. And depending on which back-end service providers you use; you get varying levels of detail from them. Each individual channel keeps its own data. I am sure they share data with advertisers as needed, but there is no one, unified source to compare Apples to Plutos. Instead, we must rely on third-party surveys and research, which quite often contradict one another. Even the quite thorough reports from Variety Intelligence, nScreenMedia, IPSOS and Parks Associates rely on relatively small samples. They do offer interesting, directional insights. However, the connected television ecosystem is as fragmentated as a windshield after a pile-up, with countless devices, platforms, channels and interfaces, making it near impossible to even get an accurate count on the number of FAST Channels, let alone a handle on who is watching what.

While the entire FAST ecosystem is getting a ton of sampling and viewership (200 million+ hours of video viewed per quarter according to Amagi), individual platforms and channels are getting either very little viewing by a lot of viewers, a good deal of viewing by very few viewers, or somewhere in between. Wurl told nScreenMedia that the average FAST Channel gets 1.5 minutes of viewing per month per active viewer. nScreen extrapolated this to devise that the average monthly active FAST user watches about 10 to 15 minutes per day, but then went on to determine that “the typical viewing session is likely much longer than this. Most people are watching a show or movie once or twice a week, which average out to the 10 to 15 minutes per day.” In other words, your guess is as good as theirs – good luck.

Which leads to a key trend driving around the FAST Track: Scale. In short, it matters.

Peacock, Tubi, Pluto, and Xumo are all owned by humongous media conglomerates, who promote and package their FAST platforms with their cable and broadcast properties, which include things like NFL Football, The Olympics and The Masked Singer. They also have access to enormous caches of content that other platforms do not. Hence the nine-figure sales totals each boasts. It is hard to imagine any of these Platforms would generate ad sales with eight zeros otherwise.

According to Conviva’s most recent CTV Streaming Report (which many of the OEMs dispute) Roku controls 41% of all CTV streaming in the US., Fire TV controls 18%, Samsung 13%. Each also runs their own FAST channels and platforms. If you are an independent FAST car racing around this track, it is hard to see how you compete with the scale of these monster trucks, considering you also rely on nearly all of them just to reach your audience. You are partnering with Platforms and/or Devices who are literally competing against you for viewers and ad dollars.

These device-makers and CTV operating systems (Android) have even more substantial advantages than the platforms: They hold leverage over the platforms who rely on the devices for reach, and they control their own data ecosystems, which include all the traffic from all the platforms and all the channels. This enables them take enormous shares of ad revenue in the FAST and AVOD marketplace. Roku’s dominance in streaming gives them a huge cache of data on AVOD and FAST user preferences, an immense benefit to exploit when they program their own Roku Channel, and massive leverage which they have converted into a larger share of the CTV market than all their competitors combined. Other CTV players have caught on to this, however, and are beginning to build momentum in both streaming and ad share, with Fire, Samsung, Android, and Vizio all seeing substantial growth in ad share year-over-year.

This brings me to perhaps most-important, long-lasting trend, currently lapping the FAST Track: The Televisioning of FAST.

FAST’s main appeal to audiences is its cost: zero dollars per month. The chief appeal to publishers is also its cost: super low. However, right now, both constituencies are getting precisely what they pay for. Viewers are finding a chaotic, nearly indecipherable set of programming cul-de-sacs, with mixed-quality programming, extremely high ad repetition, very little usable on-channel promotion, and daunting choice paralysis. As a result, publishers are garnering audiences who sample a great deal, but watch very little, amounting to shallow engagement, and less-than-desirable demographics.

This too, is a FAST call-back to the early days of Cable TV. And, just as Cablers evolved to improve their tangible business metrics, my prediction is that the year ahead will see FAST begin to mature into a real business. Serious programmers will force their channels to grow up, making major investments in programming and promotion, and hobbyists will fade away. Additionally, just as with Cable TV before it, we will see FAST programmers scale up, amortizing operations across many channels and verticals either through new launches or channel/library acquisitions, while smaller, one-off programmers will either get acquired or wither away.

This is exemplified by major moves by big traditional media companies of late such as A&E, now with eleven FAST channels; Sony aggregating their huge content library across eleven FASTs; BBC who moved from only licensing programming to other FASTs, to operating seven of their own; AMC, now bullish on FAST with 8 channels; Hearst and Cox Media Group’s local news FASTs; Hallmark’s recently launched FAST movie channel; and ViacomCBS and FOX who are all-in on FAST with PlutoTV and Tubi respectively. Among non-billion-dollar conglomerates, FilmRise, Blue Ant and Cinedigm have built substantial channel groups, with numerous channels sharing centralized distribution, ad sales and operations. Vevo, far-and-away the biggest of the music video FAST groups, personifies another growing strategy for managing operations, containing costs and maximizing revenues by partnering with white-label back-end solution provider Zype – minimizing overhead, while accessing the very latest playout tech stack.

However, with the growth of FAST among audiences, and a deep desire for more quality advertising environments among television marketers, I predict that the FAST ecosystem will see substantial maturation and professionalization in the year ahead. This will come in the back office, with grown up scheduling, ad sales and operations across the board, but also on-screen, with higher-quality content, far better promotion, and a substantial ramp-up in original programming. 2022 will see considerable Televisioning of FAST.

A good, specific example was announced recently by Fast Studios, who operate two existing sports FASTs and are about to launch a new channel, which borrows heavily from the best practices of Cable TV, adapted for a FAST future. This year, Fast Studios, which already runs single-focus sports channels Spartan TV and Racing America, will launch the Women’s Sports Network, dedicated 24/7/365 to Womens Sports and the Women Athletes who play them.

The network won’t be available as part of a traditional cable TV package. Instead, its founders plan to launch the service on free, advertiser-supported, streaming TV — the industry’s fastest-growing sector. – LA Times

The LA Times Business Section covered this launch so much like the launch of a new cable network from back in the day, I felt I had fallen into a time warp. And Fast Studios’ plan for WSN feels very much like the bravest, boldest, and smartest pioneers of the heyday of the Cable Wars. They have found an enormously underserved niche – 40% of sports are played by women, yet just 4% of sports of TV is Women’s Sport – they’ve identified a large and eager advertiser base (Nike, Amex, Adidas, Budweiser), and are dedicating enough programming and marketing investment to win the race in their space.

Sports is a somewhat popular FAST genre. World Poker Tour has thousands of hours of programming, and boasts live tournaments, so their viewership (according to interviews with insiders) is relatively high. As I mentioned above, though, the vast majority Sports Cars do not have actual live sports, and instead mostly air replays of games or matches, or shoulder programming that often leave audiences unimpressed.

Unlike any previous FAST channel I’ve heard of, Fast Studios is investing “millions” in the launch of Women’s Sports Network and on the creation of exclusive, original programming for the channel, including a daily live SportsCenter-like show focused on all things Women’s Sports. They’ve also brought on major IP partners including US Ski & Snowboard, the World Surf League and even the LPGA, timed to launch on the 50th Anniversary of Title IX in June. It’s so reminiscent of paid TV channels and early ESPN, they should call it SHE-SPN (I’ve already secured this URL, so they’ll have to pay me if they change the name). It is also likely the start of a major trend in the space.

Fast Studios realizes what few in this space have, but many will: Just because it’s linear, doesn’t make it TV. And while the linear/always-on nature of FAST is what has piqued the curiosity of viewers, a channel cannot live by sampling alone. Televisioning FAST involves investing in original programming; investing in on-air promotion; investing in and building out professional ad sales machines… If you see a trend here, it’s because this maturation process is not for the faint of heart, or the fearful of investment.

Fast Studios is not alone in this POV. In 2021, Roku greatly stepped-up their investments in both original programming and ad sales infrastructure, acquiring Quibi’s substantial slate and Funny or Die’s branded content studio. Tubi has launched original programming and was at the very core of Fox Corp’s upfront presentation. PlutoTV is now a huge part of ViacomCBS’s (now Paramount’s) ad sales strategy, with major investments in infrastructure and worldwide rollout. With just 9 million paying subs, Peacock, may not be much of an SVOD, but they are now monster player in FAST, and packaged with all things NBCU. Samsung, LG and Vizio are investing heavily in their FAST platforms, partnering with channels, acquiring programming, and even experimenting with distribution outside their own ecosystems. Amazon has ploughed enormous investment into IMDBtv and FireTV News.

Advertisers are taking notice. In 2021, according to nScreenMedia and Verizon Media, FAST platforms sold $2 billion in advertising, which will grow to more than $4 billion in 2023. That’s FAST growth.

Of course, this is eclipsed by the $29 billion in revenue YouTube had in 2021. And for those programmers, platforms and professionals living in the FAST lanes, here’s the rub…

Emerging FAST channels are not just competing with big drivers on the FAST Track, but also other premium paid digital players such as Hulu, HBOMax/DiscoBrothers, and of course, the Digital Video Death Star that is YouTube. To succeed on this Track, you will need fuel from scale, reach, professional infrastructures, far more usable dashboard data, and substantial investments in promotion and programming. This means that the advantage on this Track is with major conglomerates taking FAST seriously, and independents investing serious money into their operations, marketing, and content.

The FAST format made it easy to get a car on the road. But like any long, rough road-race, winning on the FAST Track will mean keeping your hands on the wheel, and gas in the tank, for many, many laps. In the long run, the ingredients for success in FAST will likely be different in many ways from its predecessor Cable TV. Without the dual revenue streams of subscriptions and ads, the risks will be even more complex. However, when it comes to the nuances and mechanics of programming linear television businesses, FAST Drivers will do well to draft off the best practices from linear networks that drove the track before them. If they do, they will be able to Watch These Channels Grow.